National Apartment Report – It’s A Good Time To Buy {Infographic}

“Rental rates have continued to rise year over year, while rental vacancies have steadily decreased since the burst of the housing bubble” (US News)

Someone asked me if it was a buyers or a sellers market the other day. How do you answer that?

In Seattle, the inventory is low and the prices are high.. so it is a sellers market. However, the rental rates seem to be out of control… so it is a buyers market.

Let me know your thoughts on this in the comments section below.

National Apartment Report: August 2016

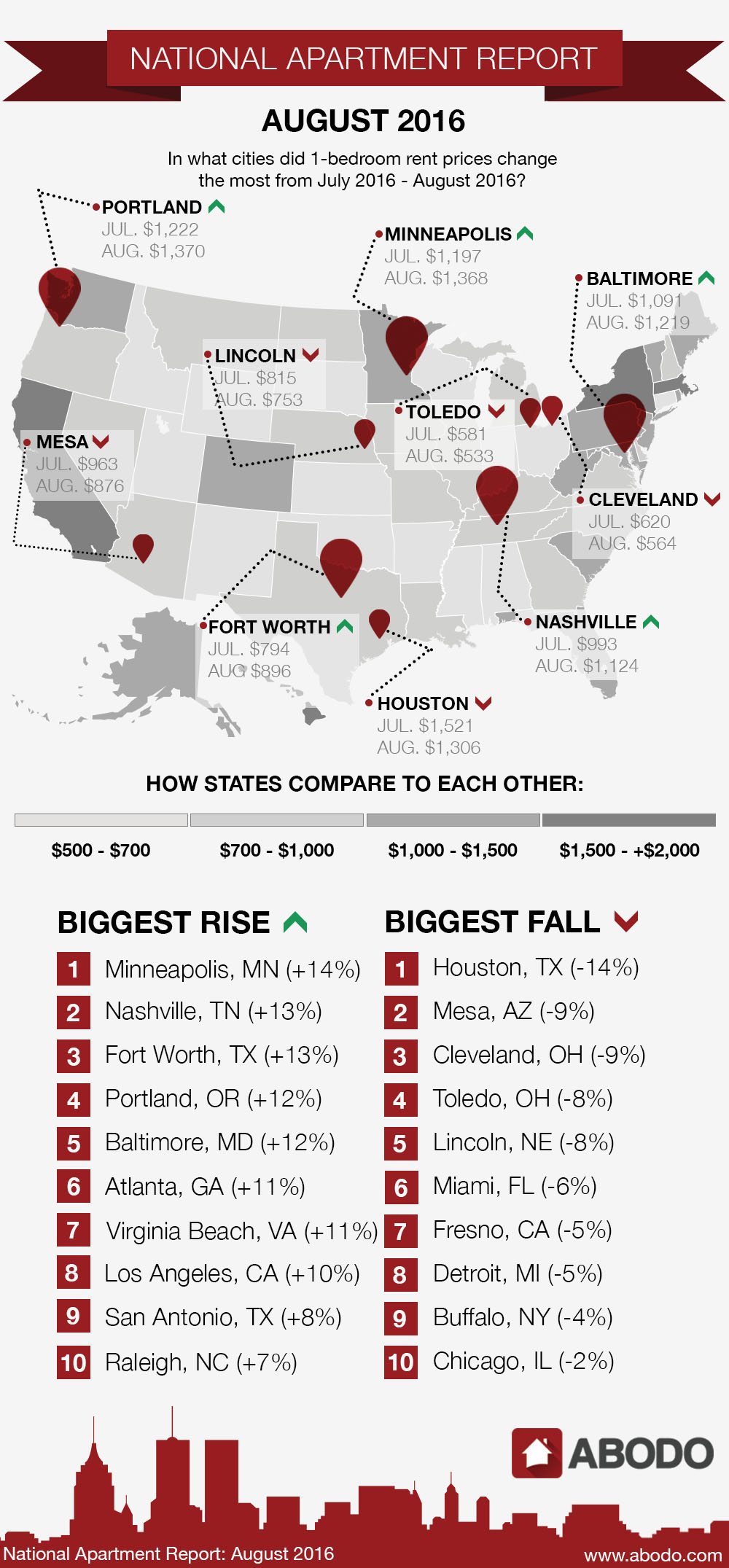

Each month, ABODO, an online apartment marketplace, produces a national apartment report. Within each monthly report is an infographic that displays the top 10 cities with the biggest increases and decreases in the average rent price for a 1-bedroom apartment.

This month, Minneapolis experienced the largest increase at +14%. And on the other end of the spectrum, Houston experienced the largest decrease at -14%.

So what does this mean for rent prices across the nation?

Well ABODO thinks that the economy plays a huge factor in the up and down swings of rent prices. In their report, ABODO states that the U.S. economy added 255,000 job in the month of July. This is the second straight month of strong employment growth. And a stable employment number and increases wages might have had an impact on rent prices.

They say that the largest sector of job growth in July was in professional and business services, which added a total of 70,000 jobs. A large number of these jobs were added in computer and technical services.

That’s good news, right? Well for cities like Minneapolis, Nashville and Portland — increasingly attractive alternatives to Silicon Valley for tech startups — this is great news. But for renters already living and searching for apartments in those cities, maybe not such great news.

In Minneapolis, the average one-bedroom now costs $1,368 per month, up from $1,197 in July, for a 14% increase. Nashville rents rose 13% to $1,124 per month, while Portland ($1,370) and Atlanta ($1,451) showed increases of 12% and 11%, respectively.

On the other hand, Houston’s economy, though diverse, is still dominated by the energy sector. And falling oil prices have had big time effects on economic growth.

Could this really be impacting rent prices? A downtick in jobs and a surplus of housing limiting the demand for every unit, it makes sense that Houston rent prices have decreased recently.

We’ll see how the next jobs report impacts prices moving forward. And we’ll have to keep our eyes peeled as election season rolls on. It will be interesting to see the ongoing changes as November nears.

You can see the full report from ABODO here.

National Apartment Report: August 2016 Infographic

post contents

“Rental rates have continued to rise year over year, while rental vacancies have steadily decreased since the burst of the housing bubble” (US News)

Someone asked me if it was a buyers or a sellers market the other day. How do you answer that?

In Seattle, the inventory is low and the prices are high.. so it is a sellers market. However, the rental rates seem to be out of control… so it is a buyers market.

Let me know your thoughts on this in the comments section below.

National Apartment Report: August 2016

Each month, ABODO, an online apartment marketplace, produces a national apartment report. Within each monthly report is an infographic that displays the top 10 cities with the biggest increases and decreases in the average rent price for a 1-bedroom apartment.

This month, Minneapolis experienced the largest increase at +14%. And on the other end of the spectrum, Houston experienced the largest decrease at -14%.

So what does this mean for rent prices across the nation?

Well ABODO thinks that the economy plays a huge factor in the up and down swings of rent prices. In their report, ABODO states that the U.S. economy added 255,000 job in the month of July. This is the second straight month of strong employment growth. And a stable employment number and increases wages might have had an impact on rent prices.

They say that the largest sector of job growth in July was in professional and business services, which added a total of 70,000 jobs. A large number of these jobs were added in computer and technical services.

That’s good news, right? Well for cities like Minneapolis, Nashville and Portland — increasingly attractive alternatives to Silicon Valley for tech startups — this is great news. But for renters already living and searching for apartments in those cities, maybe not such great news.

In Minneapolis, the average one-bedroom now costs $1,368 per month, up from $1,197 in July, for a 14% increase. Nashville rents rose 13% to $1,124 per month, while Portland ($1,370) and Atlanta ($1,451) showed increases of 12% and 11%, respectively.

On the other hand, Houston’s economy, though diverse, is still dominated by the energy sector. And falling oil prices have had big time effects on economic growth.

Could this really be impacting rent prices? A downtick in jobs and a surplus of housing limiting the demand for every unit, it makes sense that Houston rent prices have decreased recently.

We’ll see how the next jobs report impacts prices moving forward. And we’ll have to keep our eyes peeled as election season rolls on. It will be interesting to see the ongoing changes as November nears.

You can see the full report from ABODO here.

National Apartment Report: August 2016 Infographic

Latest articles

First-time homebuyers are probably eager to find their forever home in the housing market. However, there’s plenty of mystery behind the buying landscape, how to purchase and other considerations they should make.

Unlock the potential of content marketing in real estate with actionable strategies designed to boost your online presence and engage clients effectively.

The Importance of Google Rankings for Real Estate Agents Over the past fifteen years, I’ve seen how a good Google ranking can make or break a real estate business. Higher rankings mean more people seeing

BECOME A MEMBER

Become A Free DIY Real Estate Marketing Member & Get Access To:

LARGEST COLLECTION OF

Real Estate Marketing e-Books, Guides, Templates, & whitepapers

ON THE INTERNET

+ OVER 70 How To Website Training Videos including; WordPress, Agent Evolution Themes, & IDX Broker

+ DIY Real Estate Marketing Tips and Strategies Delivered to Your Inbox

Share this article

recent posts

Written by : jasonfox

Jason Fox - Real Estate Marketing

Business: We build WordPress Real Estate Websites with IDX

Me: #GoHawks, #BringBackTheSonics, #MaybeNextYearMariners, #ILoveMyKids #SeattleSunLover #SeattleWaterLover #BFF

Blog: Focuses on Wordpress Websites, Content Management, SEO Services, SEM Campaigns, Social Media Marketing, Email Marketing, Beautiful Design, IDX, and more.

A very good and a very useful article, Looking forward for more updates from you, Thank you, you can also check out for some real good